The Ethereum blockchain is a distributed ledger system designed to create decentralized applications. One of its main goals was to facilitate money transfers and get rid of intermediaries during transactions in global financial systems. One of the cofounders of Ethereum is Anthony Di Iorio.

Crisis Trials for Bitcoin

Kraken specialists described the conditions under which bitcoin will rise to $350,000.

This can happen by 2044 due to the transfer of capital by inheritance to younger generations. According to experts, the conservative generation X (people born in the 60-70s of the last century) will inherit $38 trillion, and the “millennials” (those who were born in the 80s-90s) – $30 trillion.

Millennials’ lives are deeply connected to the Internet and digital technologies, so they will prefer to invest in technology assets that will provide quick and convenient solutions. That is exactly what Bitcoin is. When calculating the potential inflow of capital into bitcoin from inheritance, the experts found that we can expect the price of bitcoin in 2044 to be at least $70,000, and at a maximum of $349,255.

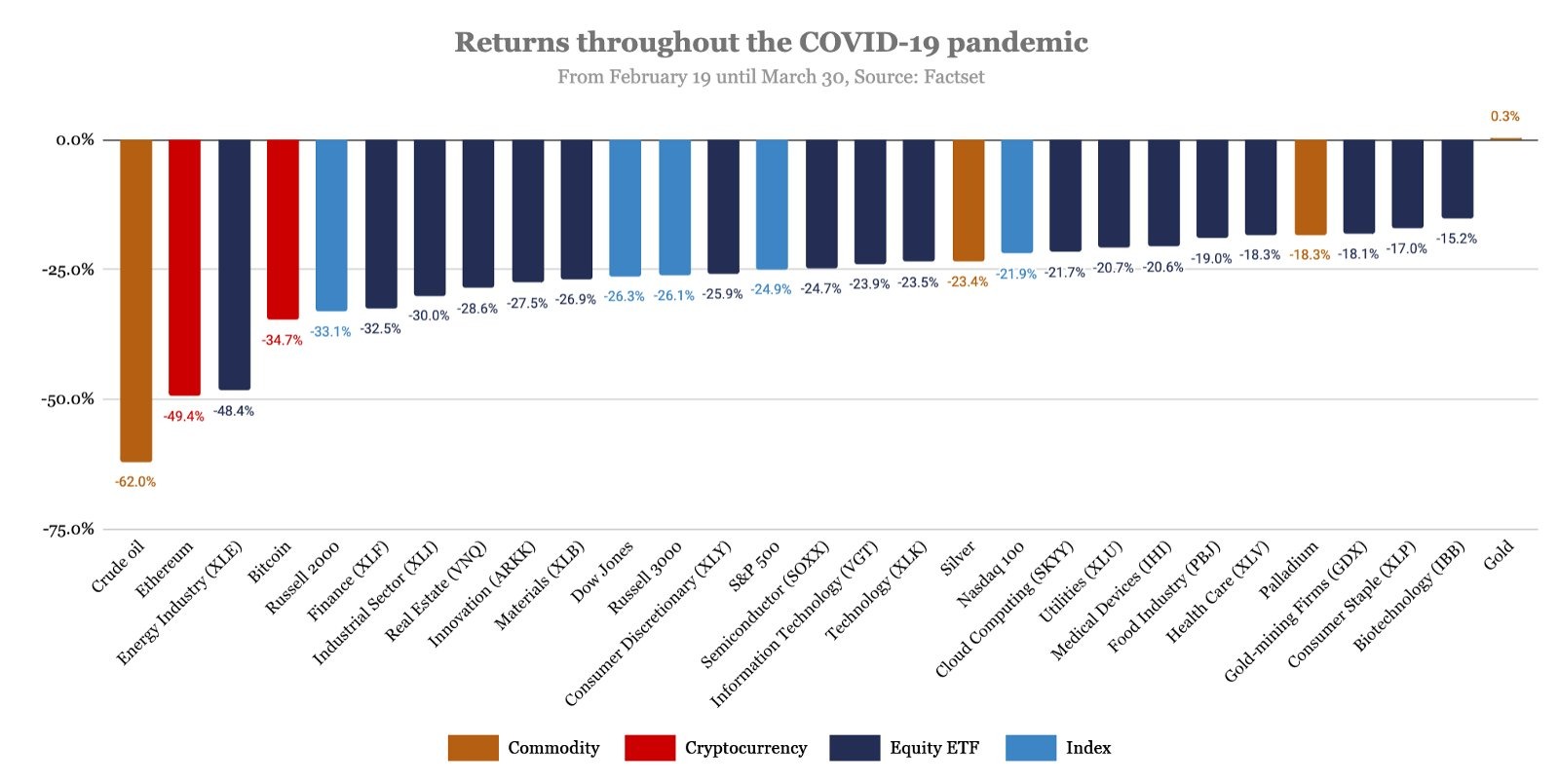

The Block: Bitcoin and Ethereum were among the underdogs during the pandemic.

Most assets on the financial market have shown a decline since the beginning of the spread of the coronavirus, and Bitcoin and Ethereum have become one of the most unprofitable. These conclusions were made by The Block analyst Larry Cermak, who published statistics on the return on assets on his Twitter. The most unprofitable assets in the period from February 19 to March 30 were oil (-62%) and Ethereum (-49.4%). Bitcoin lost 37% profitability. The only exception was gold, which showed a slight increase in profitability (0.3%).

Analyst Peter Brandt: The current crisis caused by the coronavirus pandemic is a “perfect storm” for bitcoin.

A well-known trader said on his Twitter that if the main cryptocurrency does not show a rally during the stagnation of the traditional market, then the entire crypto industry will have problems. Thus, the crisis period will be decisive for the cryptocurrency market.

Ethereum founder Vitalik Buterin plans to launch the Ethereum 2.0 multi-client testnet in April.

ETH 2.0 specifications have been audited, during which several vulnerabilities were identified, incl. the threat of spam attacks. Buterin promises to fix all the shortcomings, as was done during the launch of the first version of Ethereum. After the testnet is launched, a program is planned to reward developers who have discovered bugs in Phase 0.

Start your crypto exchange with Coin24

Exchange BTC, ETH, USDT and more — cash or card

Secure and fast crypto exchange since 2018