Dogecoin (DOGE) with the image of a Shiba Inu dog called Kabosu as its logo, is one of the most popular and successful memecoins. It is considered an altcoin and was launched in December 2013.

What is bitcoin halving and how it affects the price of BTC

Bitcoin is the most unique cryptocurrency in the world due to its properties: the process of putting it into circulation thanks to mining, the transparency of blockchain data thanks to the Proof-of-Work consensus algorithm, the open source system, etc.

One of the main values of bitcoin and its advantage over all fiat and cryptocurrencies is its limited supply. In total, miners will be able to mine 21,000,000,000 coins. The last coin will be available somewhere around 2140.

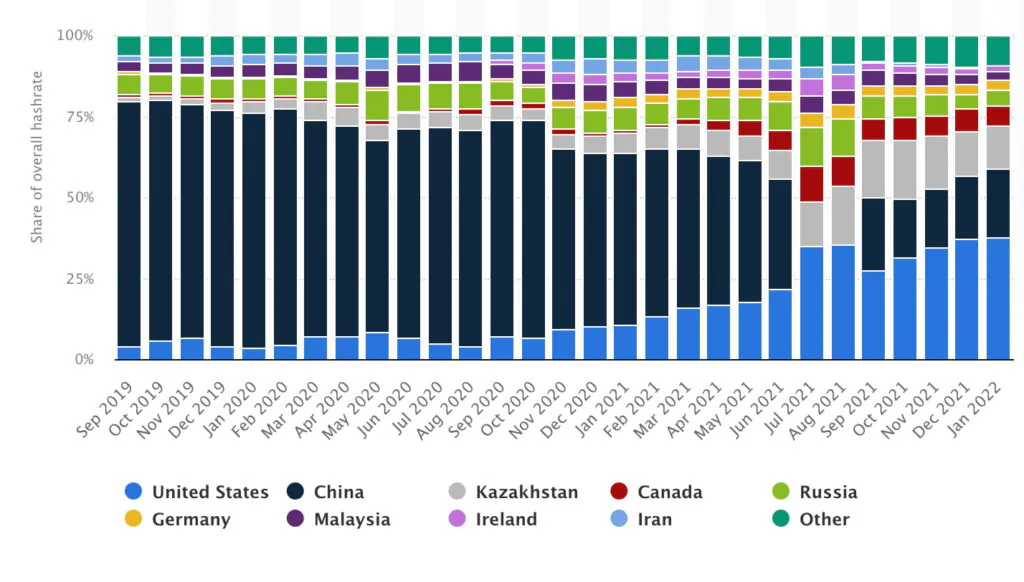

According to Statista, almost all the leading countries in the world are mining bitcoin. However, every year this process becomes more and more difficult due to such a phenomenon as halving.

So the number of mined bitcoins in the period from 2009 to 2012 was more than 10 million, from 2012 to 2016 this number decreased to 5.25 BTC, in the period from 2016-2020 the reduction amounted to 2.65 million, and already from 2020 to 2024 1.312 million BTC were mined.

It is this limited mining by mining, along with global popularity and growing distrust of fiat (bitcoin became a reserve asset in 2020-2021) that has allowed bitcoin to become the least volatile currency among all cryptoassets.

So what is bitcoin halving?

What is bitcoin halving?

The process of halving is the halving of bitcoin mining rewards about every four years. The exact amount of time remains variable: after all, halving occurs every 210,000 blocks, the duration of mining of which is not always the same.

Halving is the basis of the economic model on which the bitcoin blockchain is built. Thanks to halving, coins are mined at a steady pace that can be easily adjusted thanks to this process. Thus halving is a very simple and straightforward method of fighting inflation, which distinguishes bitcoin from all fiat currencies. The latter do not have limited issuance, which is one of the reasons for the global economic crisis today.

How the rewards decreased

Between 2009 and 2012 the reward per block decreased from 50 to 25 BTC, after another 4 years the reward decreased to 12.5.

As of 2024, 19.64 million BTC has already been mined, which is more than 93% of all coins.

When did the 2024 halving take place?

The last bitcoin halving of bitcoin so far took place in April 2024. After that, the reward was halved again, dropping to 3.125 BTC.

It is important to realize that halving is a very important, but not the only factor affecting the bitcoin price. Of course, all the previous three halving processes had a positive impact on the cryptocurrency’s price growth, but each time this growth gets lower, given the increase in the total mass of coins in circulation. This can be explained by the changing proportion of traders and miners in the market. In addition, the decrease in rewards also led to a decrease in the supply of coins in the market.

On December 16, 2024, bitcoin reached another ATH (new all-time high) at $107,793. Despite the correction that followed, this event was another confirmation that halving, combined with positive political and economic events (such as Trump’s election victory), can be a powerful boost to the price and stability of the first cryptocurrency.

A total of 64 bitcoin halving events are expected to take place before the last bitcoin is mined.

Why is halving necessary?

The main function of halving is to preserve the value of bitcoin as a currency by keeping inflation in check and clearly regulating issuance. This is the basis of what halving is. The government can print fiat money as much as it wants: whereas only 21 million BTC coins can be in circulation.

The slow pace of bitcoin mining is key to keeping the attention and interest of investors: from large corporations to individuals. Plus, there is a clear pattern between bitcoin mining and its price. Since a reduction in issuance every four years leads to higher prices, this is great news for investors. But at the same time, lower rewards make it harder for individual miners and small companies to exist in the ecosystem. So we have a very obvious pattern: when the price of a cryptocurrency rises, the number of miners in its ecosystem decreases.

In order to stay in the market, some companies have been forced to take drastic steps, such as applying artificial intelligence in their activities.

How does halving affect bitcoin?

Each halving became a springboard for bitcoin price growth. So after the first halving, BTC grew by almost 10,000%, and after the second halving – by 3,000%.

As we can see: the number of bitcoins in circulation grows exponentially – the more of them in circulation, the more difficult mining becomes.

Bitcoin capitalization increased more than 6 times in the first year after halving – from $158 billion to $1 trillion.

Pantera Capital experts predict another rise in the price of BTC to $149,000 already this year. This is quite a natural trend, because according to CoinMarketCap, bitcoin has been growing steadily since the penultimate halving in 2020. In November 2020, a new all-time high of $19,749 was reached. January 2021 was remembered by another ATH – $41,900. However, on April 14, we witnessed a new high, which was already $64,863.

When will the next bitcoin halving take place and how will it affect its price?

Each next halving is certainly an impetus for further price growth. But we should also keep in mind that bitcoin price growth is influenced by additional factors that can adjust the price after the halving.

Reasons for BTC price growth other than halving

Among the reasons for the price growth, experts point to the economic crisis of 2020-2021 caused by the coronavirus; interest in BTC of large corporate players such as MicroStrategy, Tesla, Square, Galaxy Digital Holdings; support for bitcoin and cryptocurrencies in general from the government: US President Donald Trump has noted that he wants to create a US cryptocurrency reserve; implementation of cryptocurrencies by traditional financial institutions such as PayPal, Visa, Mastercard, Goldman Sachs, Revolut; establishment of clearer regulatory rules and many other factors.

The next halving is expected to take place in 2028 at 1,050,000 units, and the reward per unit will drop to 1.5625 BTC.

Therefore, sentiment in the global stock and cryptocurrency market can also significantly influence BTC price fluctuations in the future.

And while the cyclical nature of the process allows us to draw certain conclusions regarding the events that will take place, it should be remembered that there are external factors that also affect BTC.

Start your crypto exchange with Coin24

Exchange BTC, ETH, USDT and more — cash or card

Secure and fast crypto exchange since 2018